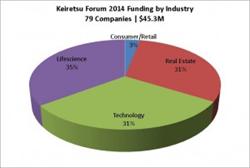

Keiretsu Forum‘s global network of private equity investors has invested $45.3m in 79 ventures in 2014.

Keiretsu Forum‘s global network of private equity investors has invested $45.3m in 79 ventures in 2014.

The average investment amount was $573,114.

Life Science companies received 35% of the funding, 31% was invested in Technology, 31% in Real Estate, and 3% in Consumer/Retail Products.

Out of the 79 companies, 9 were follow-on investments in companies that had previously raised capital through Keiretsu Forum, while the other 70 companies were new investments for the Keiretsu community.

2014 funded companies included Savara, Viakoo, Fairway America, and Ninja Metrics, etc.

Founded in 2000 by Randy Williams in the San Francisco Bay Area, Keiretsu Forum has over 1,400 investor members throughout 36 chapters on 3 continents. Members include angel investors, venture capitalists, corporate/institutional investors, and serial entrepreneurs who provide early-stage capital in the range of $250k – $2m to diverse investment opportunities.

FinSMEs

24/02/2015