MetaQuotes Software, the benchmark creator of trading platforms for brokers and exchanges worldwide, released an updated MetaQuotes MetaTrader 5 platform at the end of 2020, designed specifically for hedge funds. It’s a turnkey solution meaning that setup and implementation can be simple for those choosing to use it.

The platform is widely known for the Expert Advisor programs that are used to enhance trading profitability. These programs can be set up to either indicate highly probable trading scenarios and notify the trader, so they can take action, or give full remit to the ‘robot’ to exercise trades automatically, according to user-defined parameters.

It seems like MetaTrader 5 is a long way from widespread adoption at the moment, which means MetaQuotes are keen to market the benefits at the moment. Increased insight functionality will also help attract such buyers, who usually look for deep data to base decisions on, with their often conservative trading strategies, outlooks and systems.

There has also been an upgrade to computation power. This is most apparent in backtesting. In previous iterations of MetaQuotes trading platforms, solving optimization problems often takes half a day or even several whole days, particularly on a regular computer. With MetaTrader 5 this can take half an hour using the MQL5 Cloud Network.

Algo Trading is supported by a suite of features that make depth and insight a priority. The platform is tailored to those working in financial markets and provides a large array of complex and simple tools.

- Math Libraries. Tools to assist traders including statistics, fuzzy logic, alglib data analysis.

- Network functions. MQL5 programs exchange data with remote servers as well as sending notifications.

- Python integration. Pre-made scripts for automation and machine learning, visualization.

- Open CL support. If a backtest is run the technology increases CPU power making it quick.

- Direct X functions. A suite of ‘X’ tools that allow to create complex, animated visualizations without the third-party apps.

- SQL databases handling. This makes algorithmic trading programmable within the application.

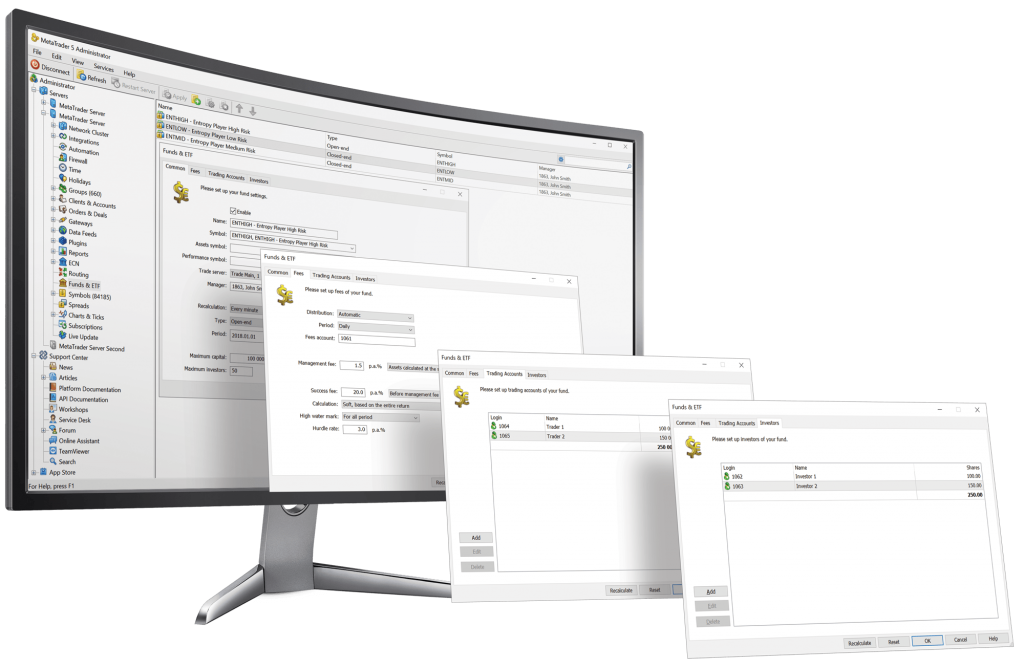

One of the reasons for the platform being offered to hedge funds is the increased level of service in the realm of client communication. For hedge funds, transparency is crucial and that’s why it will be interesting to see whether this product delivers and validates the exciting features mentioned in this tailored version. Fund clients have the ability to monitor investment in detail, directly on the platform, so that they know exactly what is going on with their funds. They (the users’ clients) are able to go a step further by buying shares themselves.

Combined with this there is a unified system for accounting operations so that it’s easy to see what is happening with finances. Controlling risks while being able to see all open positions at the same time.

MetaTrader 5 is radically different compared to competitor platforms used in large hedge funds and hedge fund-like institutions are catered for by the features within the platform.