Stacked, a Chicago, IL-based crypto-investing software that allows users to manage assets and invest in pre-built portfolios and strategies, raised $35m in Series A funding.

The round was led by Alameda Research, a core partner of FTX, and Mirana Ventures, venture partner of Bybit and BitDAO, Fidelity International Strategic Ventures, DRW Venture Capital, Alumni Ventures, Jump Capital, Motivate Ventures, CoinFund, Starting Line, Avon Ventures, Linkpad Fund, Chicago Trading Capital, Hyde Park Angels, Bitstamp, Cadenza Ventures, Launch Code Capital and Brian Barnes.

The company intends to use the funds to double its 40-person team and build out its suite of retail-friendly crypto portfolios and automated lending products.

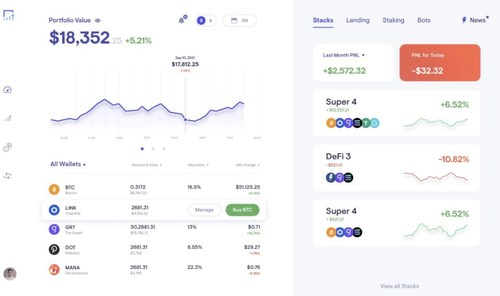

Led by Joel Birch, Co-Founder and CEO, and Stephen Beavis, Co-Founder and COO, Stacked is a crypto investment and asset management platform that connects to exchange accounts and allows users to instantly access vetted trading strategies and investment portfolios. Pre-built stacks are designed to give users instant access to pre-built portfolios modeled after some of the most popular crypto indexes, hedge funds and other investor portfolios.

Stacked supports all major exchanges and is one of the few crypto native companies licensed as a registered investment advisor (RIA).

The company, which has now raised total funding of about $40 million since its launch last year, has automated over $10 billion worth of transactions for tens of thousands of new investors so far in 2021.

FinSMEs

21/12/2021