In the currency exchange industry, traders employ a multitude of strategies to help fortify their position in the market and guarantee significant profit. But, each trader has his or her own trading style. Your behavior, market knowledge, intelligence level, gut instincts and awareness about FX Leaders’ forex economic calendar and other technical aspects of currency trading are all part and parcel of your trading strategies. All these, intertwined, form your specific trading type, which formulates your special technique to approach this volatile business.

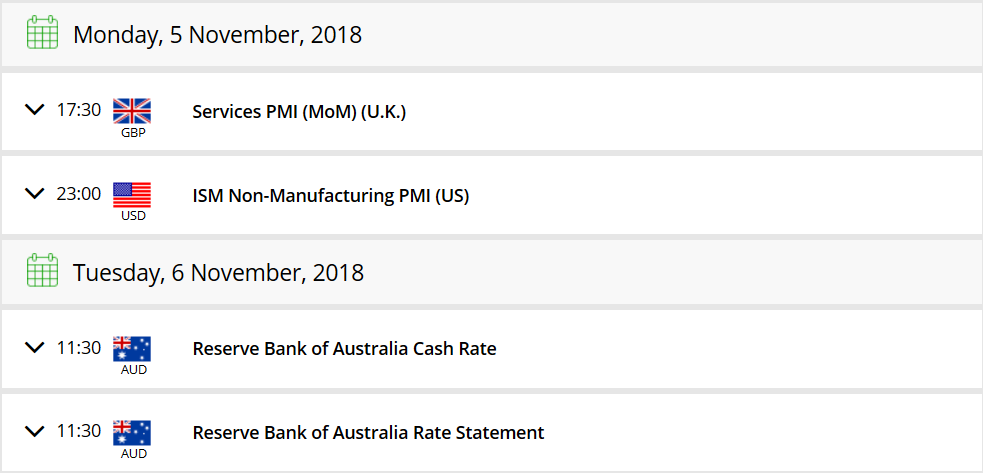

FX Leaders Economic Calendar

Knowing one’s personality when it comes to trading is essential especially that this highly influences your decisions as a trader, and also if you’re taking your skills to the next level. According to Investopedia, with regards to timing, there are different time frames that assist traders in developing and executing their strategies. All of them are interrelated to what type of forex trader are you.

Here are the four basic trader types and how to utilize them to your advantage.

1. The Scalper

Few seconds to few minutes at most are more than enough to satisfy this type of trader. They act fast and love to hold a buy/sell position during the busiest times of the day in a much more frequent approach. Although this strategy is not generally suitable for newbies as it requires an intense market knowledge and risk assessment, there are helpful articles that can aid you in developing the confidence to try this out if you know this fits your personality pretty well.

Since you’re dealing with a fast in-and-out tactic, your platform must be highly reliable, consistent, and quick to provide solutions should you encounter a problem during the session.

2. The Day Trader

This type of trader prefers short-term results. They choose to trade from the beginning of the day and finish the session with either a profit or loss. This means that they join and then quit from the market within the course of just one trading session. Since they want a quick turnover rate, they participate in a high-volume fashion, perhaps 10x to 100x the normal transaction value, and focus more on technical trading patterns. Although this suggests higher returns, the day trader always faces more risks just to earn a profit in a short span of time.

3. The Swing Trader

Somehow the opposite of the day trader, the swing trader often holds buy/sell positions in a couple of hours or so, and waits for a longer time to receive a return from the market. This is a much longer-term proposition than the previous types.

The people under this trader type typically hope for a change in direction to see if it can alter the results, and “swing” back the other way using a variety of technical analysis tools, like Fibonacci retracements and extensions.

On that note, it takes them a while before landing on a specific trading decision. Additionally, they don’t prioritize or cannot monitor the chart on a daily basis that’s why they only dedicate a couple of hours analyzing the movement in the market.

4. The Position Trader

Short-term market movements do not excite the position trader. This trader usually holds the longest position strategies among the three types. They typically take days, weeks, months or even years, and tend to focus on a long-term plan, fundamental models and opportunities. For them, it’s essential to use both fundamental factors and technical analysis to view a currency and see progress. They make decisions based on those two aspects.

Conclusion

Now that you have an idea about what type of forex trader you are, it’s time to use it to your advantage and learn more as you try it out yourself. But no matter what type you are, it’s important to stay abreast of forex signals and news 24/7 so you get a full glimpse of the opportunities and risks you’re facing along the way.