This detailed guide on how to transfer money from PayPal to GCash is written in collaboration with Carlos Reyes, analyst and writer at PhilippinesCasinos.ph. Read on as he explains the step-by-step process of how to link PayPal to GCash for fast money transfers between these two popular online payment systems.

Where are PayPal and Gcash Used?

PayPal and GCash are two of the most widely used online payment platforms and digital wallets, especially in the Philippines.

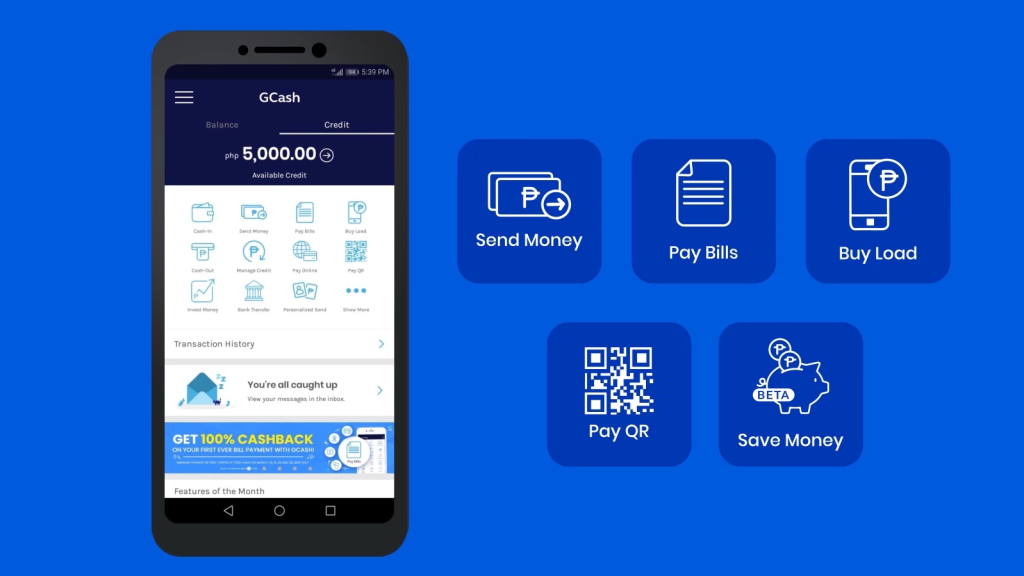

GCash is a homegrown mobile wallet that allows Filipino users to store money, make payments and play online games conveniently. Since 2004, GCash has engaged only in reliable online gambling platforms. These casinos were thoroughly tested by experts from PhilippinesCasinos.ph and gained popularity among 48 million registered users. This is why it is known as one of the best choices for cashless transactions in the country.

On the other hand, PayPal is an international digital payment system and financial platform used globally by individuals and businesses alike. With over 400 million active user accounts across 200 markets, PayPal enables online money transfers and payments for goods/services quickly and securely.

The Convenience and Benefits of Using PayPal and GCash

Both PayPal and GCash offer Filipino users a host of advantages that include:

Secure digital payments

- Send or receive money without the risk of physically carrying cash.

- Funds available in e-wallet are protected by encryption.

Quick domestic and international transfers

- Money can be sent almost instantly with just a few clicks.

- Recipients get funds directly into their stored balances.

Rewards and promos

- Ongoing deals and cashback for using these platforms’ services.

- Chance to earn free mobile load/data packs.

- Special bonuses for online casino using GCash.

Lower fees

- Very economical compared to traditional wire transfers or forex exchanges.

- Minimal charges for local and cross-border online payments.

- Low fees and exchange rates.

Cash-out network

- Available balances might be easily cashed out at thousands of partner outlets and ATMs.

- Provides accessibility through an extensive physical network.

Eligibility to Transfer Money from PayPal to GCash

To be able to transfer money from your PayPal account to GCash, the following criteria need to be fulfilled:

Verified PayPal Account

- You must have a PayPal account fully verified through OTP and other authentication flows.

- Provide accurate personal details. These include your legal name, contact information, and home address.

- Check your PayPal account credentials are securely stored and not shared with others.

Registered GCash Wallet

- Your GCash account should be activated and registered under your legal first and last name.

- Proper identity verification should be completed by submitting valid ID proof.

- Use a strong PIN code/password and enable app login authentication.

Matching Personal Information

- The personal details on both PayPal and GCash must fully match.

- Details like mobile number, residential address, date of birth etc. should be identical.

- Even minor mismatches in the spellings of names or addresses lead to linking failures.

Other Considerations

- The mobile number used for both accounts should be in your legal name and active.

- You must have sufficient balance in your GCash wallet for initiating transfers.

- Stay within the prescribed transaction limits to avoid failures.

Meeting these preconditions will help link PayPal and GCash profiles smoothly. This allows quick and simple subsequent money transfers along with maximum security.

How to Set Up the Accounts

Before connecting your PayPal and GCash, it is vital to have fully set up and activated accounts on both platforms.

PayPal Account

Follow these steps to create your PayPal account:

- Visit the PayPal website and click on Sign Up.

- Enter a valid personal email ID you frequently access.

- Create a secure 8-digit password with alpha-numeric characters.

- Verify your email address through the OTP sent to your inbox.

- Provide your mobile number to receive a verification code via SMS.

- Enter the 4-digit code to validate your phone number.

- Submit your complete name, home address and other KYC details.

- Read the terms and conditions and click Agree.

GCash Account

Similarly, here is how to register for a GCash wallet:

- Download the GCash app on your Android or iOS device.

- Tap on Register and enter your active mobile number.

- Create a 6-digit security PIN.

- Read the terms and conditions and privacy policy.

- Submit your full name, birth date, gender and home address.

- Verify email address and mobile number through OTP.

- Set-up authentication method to secure account access.

Your GCash account will now be opened, and ready for activations.

Linking PayPal to GCash

- Launch the GCash app and tap on Pay Bills.

- Select Add Biller > Digital Wallets > PayPal.

- Enter your PayPal-registered email ID and hit Submit.

- Check your PayPal inbox for an email from GCash.

- Open the email and click on Confirm to verify linking.

This simple process connects your PayPal account to your GCash profile.

How to Transfer Money?

Once your PayPal and GCash accounts are interlinked, you can seamlessly transfer money through the GCash app.

Initiating the Transfer

- Inside GCash, go to the Pay Bills section.

- Choose your linked PayPal account.

- Enter the amount you want to transfer.

- Add any notes or remarks.

- Review all details accurately before confirming.

- Authorize using your GCash PIN or OTP.

When you authorize, the money transfer from GCash to PayPal occurs instantly. However, it takes 1-2 working days for the transferred amount to reflect in your PayPal wallet balance.

Transaction Fees and Limits

When you transfer money from GCash to PayPal, here are the applicable charges and restrictions:

- Fee is 1% of the transferred amount.

- Minimum amount per transaction is ₱100.

- Maximum amount per day to be transferred is ₱10,000.

- Monthly limit imposed is ₱100,000, capped at 30 days.

Processing Time

While GCash to PayPal money transfers are initiated immediately, processing takes 1-2 working days. Only after this will your PayPal account be credited with the transferred amount.

Troubleshooting Tips

If you encounter errors when linking accounts or with transferred amounts, here are some troubleshooting tips:

Account Linking Errors

- Double check the accuracy of all entered bank/personal details, including full names, email IDs, mobile numbers etc.

- Make sure your PayPal and GCash accounts have matching personal information for successful linking.

- Contact GCash or PayPal customer support through email or chat for further technical assistance.

- Try reinitiating the account linking process from Step 1 after some time.

- Clear cookies/cache if facing issues in confirmation flows.

Transfer Amount Troubles

- Confirm the transaction fee was deducted and the amount entered was within limits.

- Check if there were any authentication failures during transaction authorization.

- Contact support teams to check if money was debited from one wallet but not credited to the other.

- Raise a formal complaint detailing your issue on the GCash/PayPal apps.

- Provide accurate transaction details like date, time, reference ID etc., to help investigate.

- Be patient and avoid repeating failed transfers, which may complicate reconciliation.

Getting Help

- Get in touch with customer service teams immediately upon facing any concerns.

- Checking account statements helps identify discrepancies faster.

- Providing complete transaction chronology assists agents in early resolutions.

Contacting support teams promptly is vital to identify and fix errors with money transfers or wallet linking at the earliest. Having all the details handy when contacting help agents enables faster ticket resolutions.

To Summarize

Linking the GCash app to your PayPal account opens up seamless and affordable money transfer capabilities between two of the largest digital payment platforms. By accurately completing the initial one-time set-up listed here, you can continue transferring pesos to and from PayPal conveniently. Checking accounts are fully KYC-compliant before initiating any online payment or fund transfer is vital.