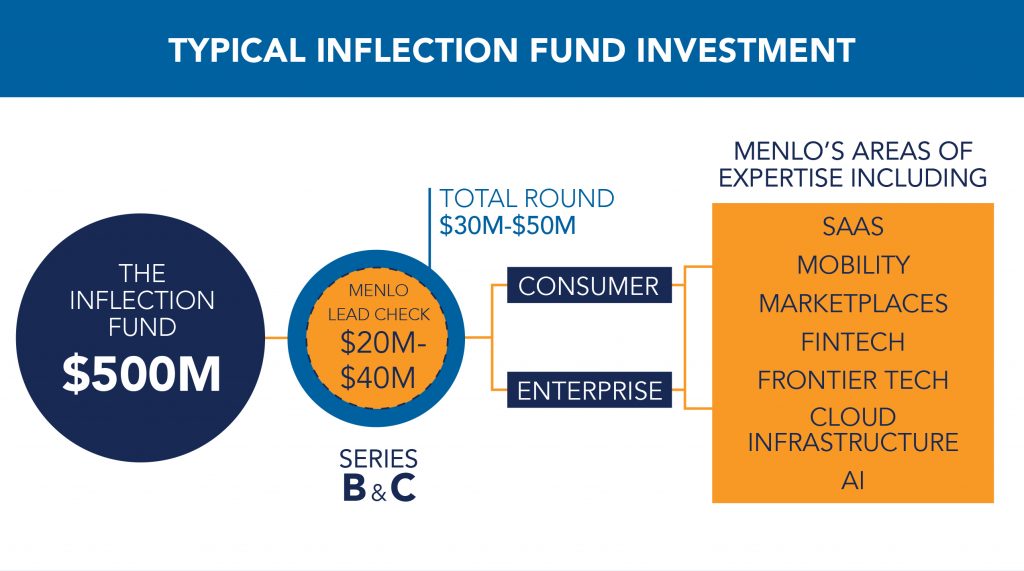

Menlo Ventures, a Menlo Park, CA-based venture capital firm, launched the $500m Inflection Fund.

The fund is designed to target soon-to-breakout companies at the point between venture and growth, which show early potential but still carry the risk inherent with scaling an organization, growing a team, and executing against a product roadmap. With it, Menlo will target companies that demonstrate:

– A beloved product

– Early product-market fit (with more than $5M in annual recurring revenue, but often less than $10M)

– Rapid growth of more than 100% year-over-year

– Early signs of efficient economics, payback, and retention

– A strong founding team with a unique perspective on the opportunity

The vehicle will make investments of $20 – $40m to companies into the growth stage continuing to invest in the firm’s areas of expertise including:

– AI,

– Cloud Infrastructure,

– FinTech,

– Marketplaces,

– Mobility, and

– SaaS

across the broader categories of consumer and enterprise businesses.

Led by Partners Mark Siegel, Matt Murphy, Shawn Carolan, Tyler Sosin, Venky Ganesan, and Steve Sloane, Menlo Ventures has already made inflection stage investments in startups such as BitSight, Carta, Chime, Envoy, Everlaw, HomeLight, Rover, ShipBob, Signifyd and Qualia. The goal is that these startups will follow Menlo’s more established portfolio companies such as Betterment, BlueVine, Pillpack, Poshmark, Uber, and Roku all funded by Menlo at the inflection stage.

FinSMEs

20/02/2019