Pesto, a San Francisco, CA-based provider of an asset-backed secured credit card, raised $11M in funding.

The round saw participation from Activant Capital, Plural, Sozo Ventures, Commerce Ventures, NJF Capital, Soma Capital, NOMO Ventures, Commerce Ventures, Human Capital, OVO Fund, OEL Ventures, Core Innovation Capital, Great Oaks VC, and Y Combinator.

The company intends to use the funds to expand its customer base across the US, with an initial focus on Atlanta and Los Angeles.

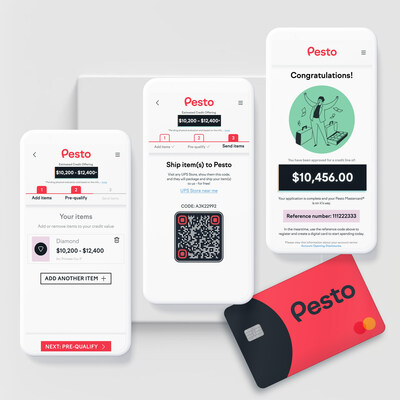

Led by James Savoldelli, Founder and CEO, Pesto is a fintech company that has launched an asset-backed secured credit card, the Pesto Mastercard, in 2023. With it, users can secure liquidity and build credit through their assets—without having to sell them. Pesto Mastercard, issued by Continental Bank, enables consumers to send Pesto their assets and are provided with a credit card based on their value, regardless of credit score. Over time, cardholders who often don’t qualify for an unsecured credit card have the ability to increase their credit score and eventually qualify for one. It offers rates similar to existing credit cards, which are substantially lower than what pawn and payday loan clients typically pay.

FinSMEs

25/05/2023