Ratio, a San Mateo, Calif.-based fintech platform, emerged from stealth raising $11M in venture funding and a $400M credit facility for customer financing.

Backers include Streamlined Ventures, Cervin Ventures, 8-Bit Capital, HoneyStone Ventures, multi-billion-dollar asset managers and a range of tech CEOs from both large and small companies.

Led by Founder and CEO Ashish Srimal, Cofounder and CTO Mason Blake, Chief Commercial Officer Carlos Chou, and Chief Risk Officer Sai Uppuluri, Ratio combines payments, predictive pricing, financing, and a quote to cash process into one platform for SaaS and technology companies. Its platform is built around two core products:

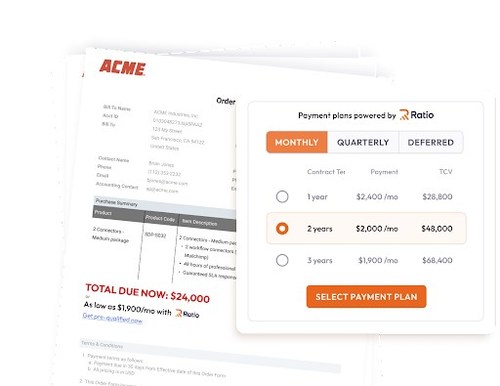

- Ratio Boost, a fully integrated BNPL payment, optimized pricing, and checkout product, embedded via API into the seller’s systems and processes at the point of sale. Customers get ultimate payment flexibility, by matching their cash flow needs, and a buying experience automatically tailored to their company’s unique needs, while vendors get paid cash upfront for each customer contract, minimizing discounting and dilution.

- Ratio Trade, a non-dilutive upfront capital solution for high-growth SaaS and recurring revenue companies backed by their portfolio of contracts. With Ratio Trade, vendors no longer have to discount their offerings or dilute equity to access working capital — and they can access financing in days, not months, to keep growing their brands.

FinSMEs

15/09/2022