The Covid-19 pandemic has accelerated a pre-existing trend of retail investors buying into sustainable stocks to add more environmentally and socially conscious options to their respective portfolios.

Although 2022’s IPO market has been impacted by factors relating to inflation, the ongoing pandemic, and geopolitical conflicts in Eastern Europe, investors can still expect a range of high-profile, sustainability-focused debuts over the coming months – particularly in the field of meat substitute foods.

With much to be made of sustainability stocks at a time when post-pandemic societal changes are causing more consumers to take notice of ESG (environmental, social, and governance) stocks, Maxim Manturov, head of investment advice at Freedom Finance Europe (Freedom Holding Corp. (Nasdaq: FRHC), shares his thoughts on two of 2022’s most exciting sustainability-focused floatations:

Global attention turns towards sustainability

Throughout the past two years, we’ve seen a significant shift in the volume of retail investors buying into companies that boast strong ESG credentials that can be traced. We’re seeing sustainability become important to businesses due to the link between changing global conditions and an ongoing shift in consumer interests. In this regard, the future of the planet has not only become a key matter for the public, but also for business strategy.

Improving sustainability is a challenge that faces many businesses, and can carry implications regarding supply chains, company operations, employee wellbeing, and the natural resources required for your business to operate.

By looking to improve sustainability, a company can actively improve their shareholder confidence alongside achieving its altruistic goals. This, in turn, can provide a boost to the stock performance of a company as more ESG-focused investors look for sustainable options.

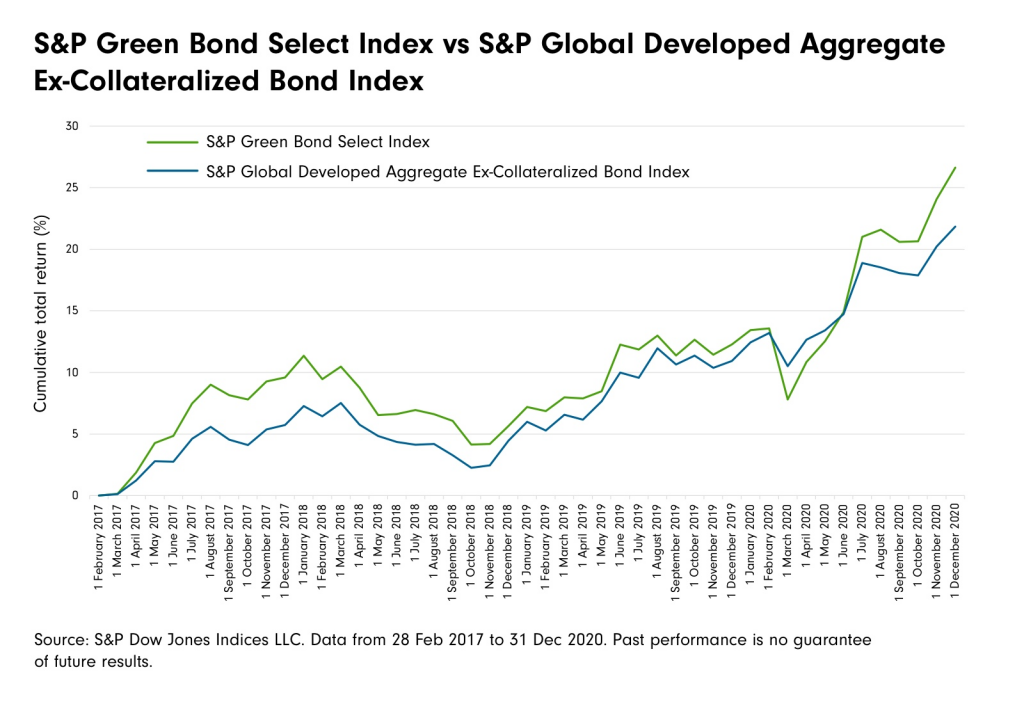

Available evidence offered by sustainability-focused bonds like the S&P Green Bond Select Index, we can see benchmarks continually being outperformed, and an acceleration of cumulative returns on investments following an initial dip in early 2020 as the Covid-19 pandemic sparked widespread stock sell-offs.

One of the sectors that’s seen much growth in recent years as consumer interest in sustainability has gained momentum is that of meat substitute products. According to analysts, there is plenty of reason for optimism surrounding the industry for the coming decade.

Furthermore, a recent Bloomberg article suggested that the global plant protein market will grow to a value of $162 billion by 2030. Supplemented by this growth, sales of plant-based meat and fish alternatives may account for as much as 5% of the total meat and fish market over the same time frame.

According to H2 2021 figures, the alternative meat market is currently worth around $4.2 billion, and has the potential to grow to around $74bn within 10 years should it follow the same growth patterns as the plant-based meat market. This indicates growth of over 1,750%, and goes some way in indicating just how much potential meat alternative IPOs may hold for retail investors.

With this in mind, let’s take a look at two sustainable meat-free IPOs that are set to debut in 2022 which may offer a strong long-term upside for investors:

- Impossible Foods

Founded in 2011 and headquartered in Redwood City, California, Impossible Foods is a startup that’s focused on creating the next generation of alternative meats and plant-based cheeses. The company excels at selecting specific proteins and biologically significant elements from greens, seeds, and grains.

It’s through these various combinations that can pave the way for the production of many meat and dairy alternatives.

The mission objective of Impossible Foods is to combine the pleasure of food with the safety of humans consuming the products and animals alike – eliminating the use of animals from the production chain as a result.

In 2019, the FDA approached a significant ingredient for Impossible Foods – a plant-based blood imitator, which enables the company’s Impossible Burger range to deliver a true-to-life beef-like appearance and taste.

In terms of fundamentals, Impossible Foods has raised a total of $2.1 billion in funding rounds, with the most recent round of investments arriving in November 2021, with a $500 million investment coming from Mirae Asset Global Investments. The startup’s most recent valuation priced the endeavor at $7 billion – a value that’s likely to grow provided that meat-free alternatives continue their rise in popularity.

In April 2021, sources close to the company reported that an Impossible Foods IPO was likely to occur in the next 12 months. However, due to market volatility, it’s more likely that the debut will take place in the second half of 2022.

- Huel

Huel is a British company that experienced rapid growth into markets across continental Europe, the US and Japan. The startup specializes in food substitutes in the form of powders, drinks, snacks, and other alternatives. At present, Huel has an estimated market capitalization of £1 billion.

One of Huel’s biggest assets is its social media presence, which has shown time and again that it can attract a large audience of young consumers who are not only interested in sustainability, but also the company’s emphasis on delivering fitness-focused meat alternatives.

The startup has reportedly enlisted the help of Goldman Sachs and JP Morgan as advisors for a potential London IPO in 2022. Investment banks are also circling in anticipation of a potential sale of the company – though at this stage an IPO is believed to be the preferred option.

Significantly, the company’s turnover in July 2020 was almost 30% higher than the year prior, with Huel taking in £71.6 million.

Looking for clues from the past

So what can we expect from Impossible Foods and Huel following their IPO? The indicators appear to be strong when considering the case of Beyond Meat, which experienced a pop on launch day of 167.2$ (to $66.79) after the firm debuted at an IPO price of $25 in 2019. Before lock up, the stock had rallied by 545% to a price of $161.24.

However, investors will need to be wary of growing competition in the field. As the industry is still emerging, market leaders can come and go and should a more innovative product appear on the market, otherwise high quality companies can begin to suffer.

With this in mind, it’s always worth researching and revising respective fundamentals for upcoming IPOs – even if in promising industries. But as consumer interest in sustainable goods continues to grow, there’s little doubt that the meat alternatives market is set to soar in value over the course of the decade.

DISCLAIMER: THIS CONTENT IS NOT INTENDED AS INVESTMENT ADVICE