Monite, a Berlin, Germany-based finance management platform that automates the admin and accounting processes for SMEs, has just raised €1.1M in pre-seed funding. In conjunction with the announcement, Ivan Maryasin, the CEO of the company, answered our questions about the company, its solutions, the funding round and future plans.

FinSMEs: Hi Ivan, can you tell us a bit more about you. What’s your background?

Ivan: Hi Ermanno, thank you for inviting me, I’ll be glad to introduce myself. I have over 8 years’ expertise in growing startups in Silicon Valley and Europe — I worked with People.ai (YC alum, funded by a16z), BrightEdge (Series D, profitable), and others. Before launching Monite, I led growth for Penta, the key German B2B neobank, bringing it from 0 to 20k customers. Working with Penta I realized small businesses struggle a lot more with admin & accounting than they do with banking.

Then I met Andrey Korchak, Monite co-founder and CTO. At that time Andrey Korchak led the tech team at Tochka Bank, the biggest SME neobank in Eastern Europe, and just finished building a super-app for freelancers with integrated tax & accounting service. Together we decided to bring proper admin & accounting automation to the European SMEs in a unified platform and started Monite.

FinSMEs: Let’s speak about Monite. Which is the market problem do you want to solve? Which is the real opportunity?

Ivan: Small to medium-sized businesses spend on average 15 hours per week or 19% of their time in total doing financial admin tasks. Although it becomes one of their most time-consuming business activities, not all companies even try to streamline these processes with software tools — e.g. only 45% of UK companies are using technology to manage their administrative tasks, while others waste billions on admin every year. Monite aims to solve this problem and combines accounting and admin tools in one platform, saving time and significantly reducing costs.

FinSMEs: How does it work? Which are the main features?

Ivan: Monite automates operational tasks for freelancers and companies up to 100 employees across different industries.

A company can connect its bank accounts and get one online banking interface for all the accounts – they can see & categorise transactions, attach receipts, and make payments. It’s like getting the best neobanking experience and functions with any bank, even the most traditional one.

Monite also lets companies run all the admin processes in one place – they can invoice clients, receive & pay incoming bills, log expenses & pay reimbursements, etc. Monite then automatically maps all the documents to transactions and prepares the information for the tax accountant, so they can export to the tax system and complete the tax return. What used to take tens of hours is now automated. In addition, Monite saves and organizes documents in a tax-compliant way and provides a full finance overview of the company.

FinSMEs: What are the features differentiating the product from competitors?

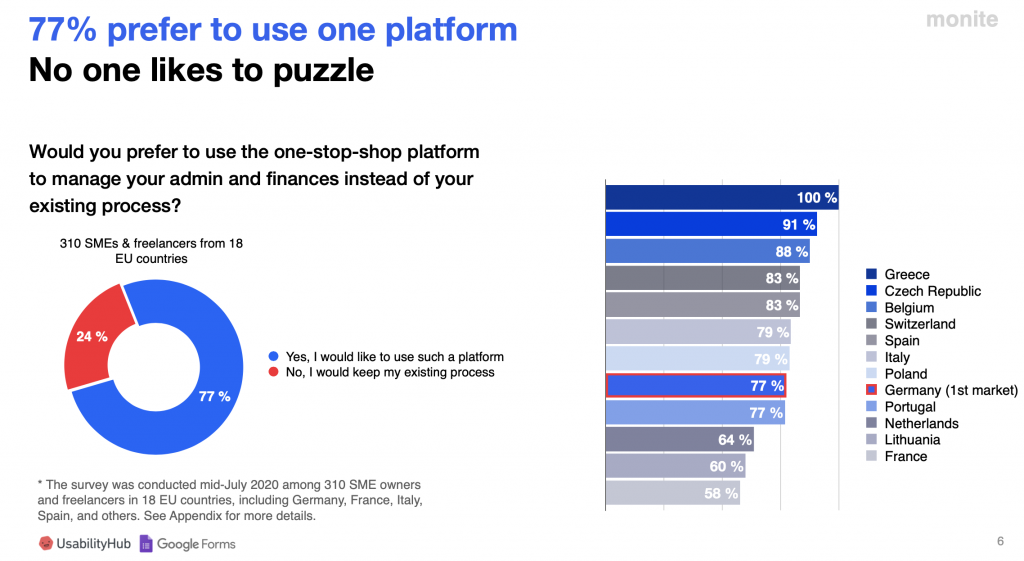

Ivan: There are lots of projects, offering tools for particular verticals: accounting, invoices, expenses and others. We conducted research and found 76,5% of SMEs and freelancers prefer to use one platform for the admin needs, rather than constantly switching between 5 or 6 narrowly-focused tools. Unlike its competitors, Monite is coming out with the whole platform solution and automates all operational activities in a unified tool.

FinSMEs: You just raised a new funding round. Please, tell us something more about it…

Ivan: Yes, Monite raised €1.1M in pre-seed funding from Tomahawk VC, signals Venture Capital, InVentures, Runa Capital, and a number of angels. Our lead angel is Ralph Müller, a top-3 fintech angel in Germany and ex-Deutsche Bank Board Member who led all their SME programs. We are very lucky to have such a strong combination of investors on board – some bringing more company building expertise and some providing us with unique SME market insights and the network.

With this funding round we’ll improve the platform and open new product lines by the end of 2021.

FinSMEs: Can you share some numbers and achievements of your business?

Ivan:

- Monite replaces 10+ tools saving entrepreneurs 50% of time and costs they spend today on admin & accounting

- We built the whole platform with 2 devs on bootstrap. That’s because we’re bringing a 2021-tech stack to the game – exactly what it takes to disrupt the SME finance

- 77% of SMEs prefer a one-stop-shop

FinSMEs: What’s your medium-term plans?

Ivan:

In short – more automation and convenience, plus going after the EU market.

In 2021 and 2022 we are planning to deliver a lot more time-saving functions that let business owners automate their admin tasks even more. Starting with things like pulling a receipt automatically when you pay on Amazon and attaching it to the transaction and going deeper into the user flow and automating things like invoice debt collection.

At the same time, with the next financing round we’re planning to tackle the bigger European market and integrate more 3rd party offerings into the product, such as loans, factoring, insurance, and more. Why have it all in different places when you could save so much time doing everything under one hood?

FinSMEs

04/03/2021