DNX Ventures, a San Mateo, Calif.-based early-stage venture capital firm focusing on B2B startups in the US and Japan, closed its third $315m fund.

With this new fund, the firm will continue to invest in early-stage B2B technology companies that are looking for long-term partners and support at every stage of their growth, and build strategic relationships with corporate enterprises.

DNX Ventures will invest from its offices in Silicon Valley and Tokyo, Japan, supporting companies in their early stage funding of all sizes from $1M to $5M. The firm will continue investing in its areas of expertise spanning cloud and enterprise software, cybersecurity, frontier tech, fintech, and retail tech.

Fund III has already invested in several B2B startups in the US and Japan. The investments in the US include Banzai, Diligent Robotics, Macrometa, Mitiga and Paystand. In Japan, investments include Herp, Techtouch, Tutorial, Resily and Adacotech.

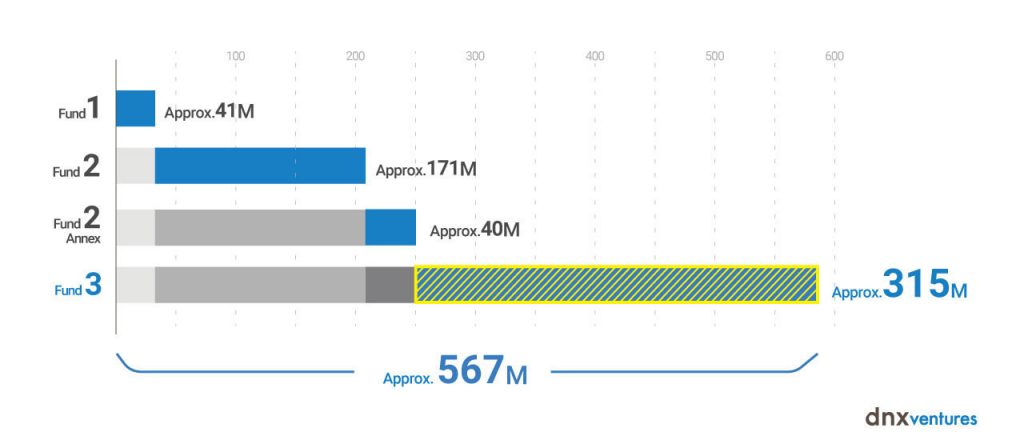

Led by General Partner Q Motiwala, DNX has been investing in B2B startups in the US and Japan since 2011. To date, the firm has managed 3 funds with a cumulative total of approximately $567 million which incorporates supplementary annexed funds and has invested in over 100 startups, resulting in 13 M&As/IPOs.

DNX is a member of the Draper Venture Network, a global alliance of over 30 venture capital firms.

FinSMEs

09/09/2020