Bitcoin is 10 years old. And, after all, is in good health. During the past decade, historical ups followed by catastrophic downs and viceversa took the stage. Thousands of articles about its mysterious founder(s), its evolution, real and clearly unreal price predictions, and its near future death, have been published.

A period also marked by security issues, frauds and country bans, which have often put it a severe risk of survival.

Anyways, at the very beginning, investors failed to give attention to the new digital currency (valued at $0.08 in 2010). They did not know Bitcoin, which, by the end of 2019, would have increased its value by an unbelievable 62.500%, becoming the most-profitable investment of the decade, a period which saw companies like Facebook, Twilio, Airbnb, Twitter, Deliveroo, and many others to launch and thrive until our days.

For this reason, today, we can affirm that Bitcoin is in good shape, at least in terms of current valuation.

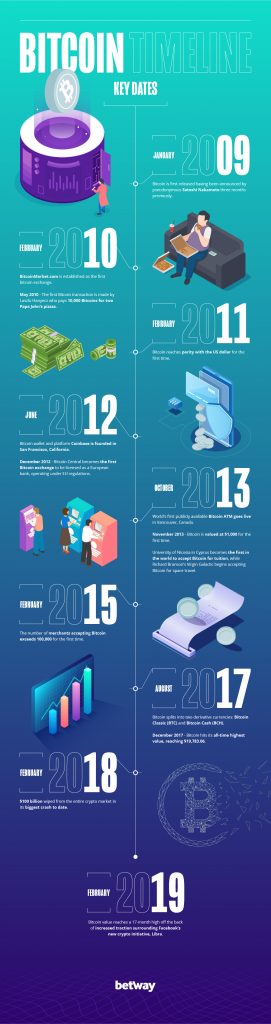

Launched in early 2009 by mysterious Satoshi Nakamoto, who has kept his/their identity secret since releasing Bitcoin’s original blueprint on 31 October 2008, Bitcoin was traded in March 2010 for the first time on BitcoinMarket, the first formal bitcoin exchange.

In the following years, the cryptocurrency went mainstream with some relevant use coming from online gaming sites. But in the meantime, competitors emerged. Other cryptocurrencies such as Ripple and Ethereum were launched along with unlikely altcoins while, in a more advanced stage, Bitcoin ATMs started proliferating globally.

Below, produced by Betway Casino, have a look at an infographics showing the most ridiculous altcoins ever created so far

After years of consistent growth, in 2017 Bitcoin broke records reaching $19,783.06 by mid-December, which remains the highest-ever value, even triggered by the ICO bubble, but soon after the value dropped, crashing hard to under $3,300 by the end of 2018. 2019 was more positive. The cryprocurrency reached its highest price in more than a year in May 2019, rising to £10,908.18, dropping a little in June 2019 and fluctuating around this level ever since.

The infographics were taken from Betway’s Insider.

Nobody can predict the future of Bitcoin. Several factors can affect its price and value. The next reduction of block reward to miners, from 12.5 bitcoins for each new block of transactions to 6.25 bitcoins, can influence it. Increased competition from the Facebook’s Libra, next to be launched, or the continued growth of Ethereum can add pressure.

Beyond technological and security challenges, we think that the value of Bitcoin, overall, will mainly depend on the use people will do of it. A recent research from Chainalysis showed that only 1.3% of the economic transactions in the first four months of 2019 came from merchants. Given this, Bitcoin economic activity continues to be dominated by exchange trading.

In our opinion, in order to finally flourish, more than being considered as “digital gold”, Bitcoin needs to attract appeal as a viable electronic alternative to money instead of leaning on a culture of “hodlers”, who prefer accumulating rather than spending.