New data shows that European venture capital has matched the performance of US funds over the past 20 years.

According to alternative investment technology firm eFront, the all-time pooled IRR US venture funds is nearly 10% higher than for European ones at 14.35% versus 4.95% in US dollars.

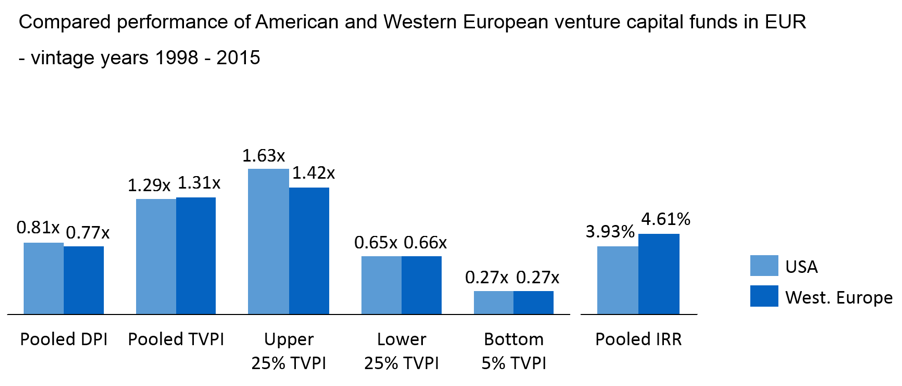

Western European venture funds generated a pooled IRR of 4.61%, compared with 3.93% for US funds, and performance of European and US funds was broadly similar across all metrics.

The discrepancy in previously reported performance figures comes from currency and sample biases. Reporting data in US dollars introduces a bias affecting the comparison of US and European venture capital.

By switching the currency of reference to euros, the performance of European venture capital improves.

In addition, fully realised US venture capital funds benefited from particularly favourable conditions in the 1990s. European venture capital did not experience such a boost, as the sector was still nascent at this point. A more rigorous approach would therefore focus on the identical vintage years of 1998-2015. Once these biases are eliminated, the vast majority of performance differences between US and European funds disappear.

According to the research, these figures have implications for investors’ asset allocations – in particular as many in the past have concluded too fast that they should disregard European venture capital.

FinSMEs

09/04/2018