The equity shares have all but shrugged off geopolitical events. North Korea has fired missile after missile into the Pacific with two flying directly over Japan, but market participants continue to bet on further gains in riskier assets. The United Kingdom, as well as, Spain have felt the brunt of terrorist attacks this summer, with the latest one in London, but markets seem to see these events as par for the course. What the markets do seem to care about is central bank activity.

The Federal Reserve is the big daddy of them all and while they are unlikely to pull the trigger on higher rates until December of 2017, market participants are concerned with a change in the Fed’s balance sheet.

Could QE Be Going Away?

During the financial crisis which began in 2008, the Fed started the process of adding government bonds to their balance sheet to buoy riskier assets. The theory is that if rates are low enough, investors will move out the risk spectrum to look for a better return. Beginning in 2012, the Fed began an open ended bond purchase program which ended in 2014. Thereafter, the Fed just continued to roll over their proceeds and purchase new bonds. Investors now expect when the Fed meets in October they will announce a reduction in their bond purchase program, which will lead to quantitative tightening.

What has caught the markets attention is the recent change in inflation expectations which has slowly increased, but could be transitory. U.S. CPI increased by 0.4% in August, with the core rate increasing 0.2%. These month over month numbers equate to an annual pace of 1.9% year over year for the headline, versus July’s 1.7%, while the core came out at 1.7% year over year. While the Fed is looking for a rate of 2% to fill its mandate for tightening, a number that is close to their objective will not stop them from reducing their bond purchase program.

Inflation Expectations Were Stronger Than Expected

The reason many think the climb in inflation expectations was stronger than expected was due to the recent hurricanes. With Hurricane Maria now bearing down on the Caribbean Islands, there is a chance that energy prices will continue to climb. Energy prices, as part of the August CPI, surged 2.8% thanks to Harvey. Gasoline prices surged in September thanks to Hurricane Irma. Additionally, transportation costs were up 1.4% in August, rebounding from -0.1%. Food and beverage prices edged up 0.1%, as did apparel prices. Commodities climbed 0.5%. While the strength in inflation has important implications for the FOMC, hurricane distortions will make the data difficult to judge. With more Hurricanes on the way, this metrics might be skewed even further.

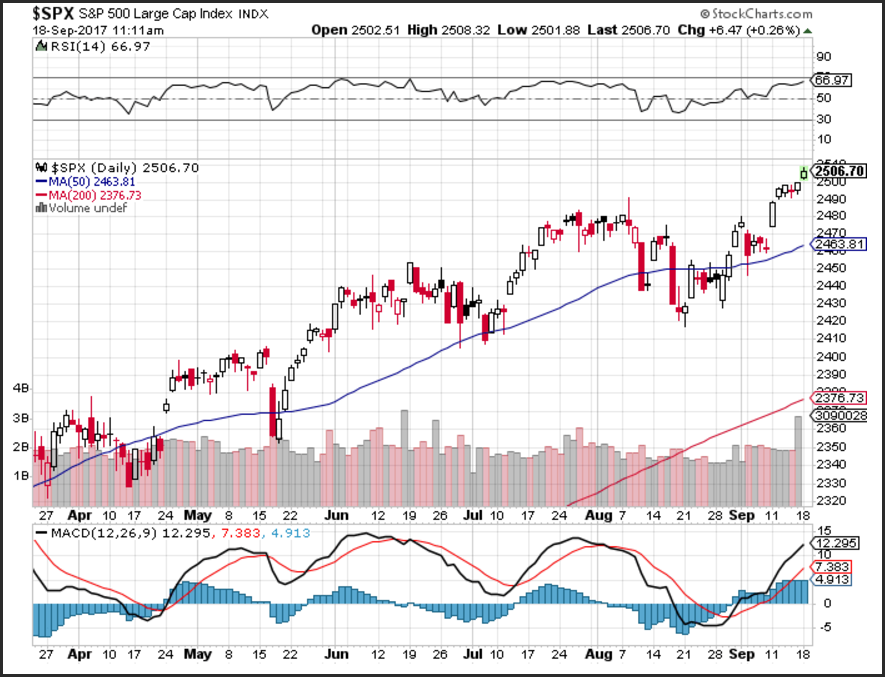

Despite the Fed possibly tightening monetary policy and geo-political events continuing to generate a wall of worry, the S&P 500 index has climb to a fresh-all time high, showing that investors believe there continues to be value in riskier assets.