Disruption is the key word in the tech world.

Disruption is the key word in the tech world.

And it is what startups try to do daily. Have a look at how software is eating the enterprise, how it is changing our way to work, to commute, to travel, to live our home, to go shopping, to get access to healthcare, to manage, borrow and raise money.

Daily covering funding news, we have noticed an other wave rising up: “InsurTech”, namely the attempt to disrupt the old insurance industry, comprised of corporate giants that have often celebrated their (innovation) slowness.

Generally speaking, until last year, the attempt to innovate the industry was limited to bring transparency to national markets in the way consumers select and acquire policies, helping them compare prices and features of products. In the latest months, instead, investment activitiy in startups leveraging advancements in technology (think about mobile, IoT and wearable applications) to create solutions to face other issues in the value chain, from the front end, improving the relationship between customers and firms, to the back end, analyzing the single customer’s behaviour to improve risk management processes and customize products and increasing security, just to name a few.

Not so simple, of course. But something is moving on.

Some corporations have started understanding that embracing innovation requires a strategic effort that cannot be delayed anymore. Venture capital firms know the potential of the global market for insurance telematics, which is forecast to grow at a compound annual growth rate (CAGR) of 80.20% over 2013-2018 (read here).

Have a look at some interesting examples of activity across the Insurtech arena.

In the USA, for example, CoverHound, a San Francisco, CA-based digital platform for comparing and purchasing insurance, raised $33.3m in Series C financing in September. The round, which valued the company at over $100m, was led by ACE Group (NYSE: ACE), a multiline property and casualty insurer, with participation vcs RRE Ventures, Blumberg Capital, Core Innovation Capital, Route 66 Ventures and American Family Ventures, the venture capital arm of American Family Insurance.

In addition, Insureon, a Chicago, IL-based online provider of technology and an online marketplace platform for small companies to research, buy and manage policies directly with U.S. carriers, raised $31M in equity funding.

Collective Health, a San Mateo, CA-based enterprise health insurance software and services provider, secured $81m in Series C funding. Backed by Google Ventures, New Enterprise Associates, Founders Fund, Maverick Capital, Redpoint Ventures and RRE Ventures, the company currently offers complete health insurance solution for U.S. companies.

In Europe, some days ago, two insurange management platforms raised vc funds.

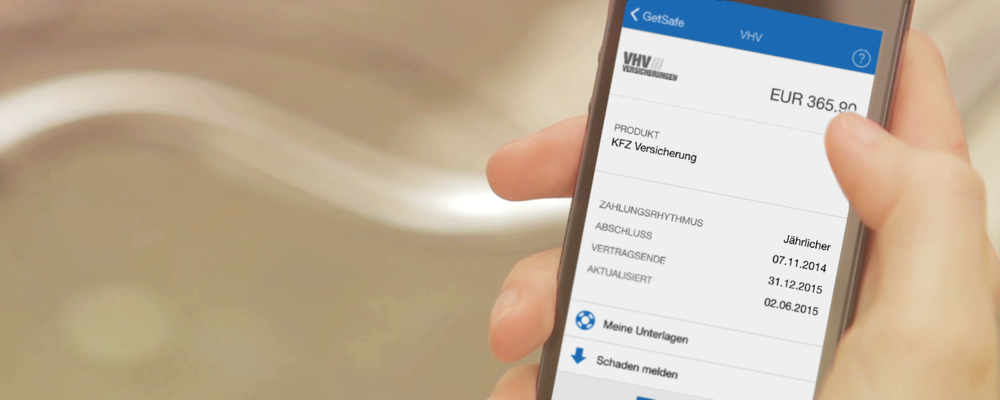

GetSafe, a Heidelberg, Germany-based digital insurance manager for smartphones, secured a single-digit million euro investment from b-to-v, CommerzVentures, Acton Capital Partners, Capnamic Ventures, Iris Capital, Partech Ventures, Rocket Internet and HW Capital.

Knip, a Berlin, Germany- and Zurich, Switzerland-based digital insurance management platform, raised nearly €14m in a round led by US Route 66 Ventures, with participation from other American investor QED Investors (USA) as well as European Creathor Venture (Germany), Orange Growth Capital (the Netherlands) and Redalpine (Switzerland).

As said above, the corporate world is beginning to make the first moves. For example, Generali acquired MyDrive Solutions, a London, UK-based company that uses customer data gathered from a series of technological instruments, such as blackboxes or smartphones, to formulate predictive algorithms and to define behavioural scores, i.e. assessments of users’ behaviours, enabling those who choose new products to receive customized commercial offers.

The insurance giant is also opening a new hub for telematics and big data to enhance its operating platform and develop smart products, tailored to the customers’ specific needs, benefiting from connectivity and exploiting all the potential of data analytics.

In addition, AXA has just launched Kamet, a €100m InsurTech incubator dedicated to conceptualizing, launching and accompanying disruptive products and services for insurance clients.

FinSMEs

31/10/2015