The company’s 2019 Interim Financial Report has been prepared according to the IAS/IFRS accounting standards, which provide, among other things, for the conversion of the previous Interim Financial Report’s data, in order to conform to clear comparability parameters (1).

The company’s 2019 Interim Financial Report has been prepared according to the IAS/IFRS accounting standards, which provide, among other things, for the conversion of the previous Interim Financial Report’s data, in order to conform to clear comparability parameters (1).

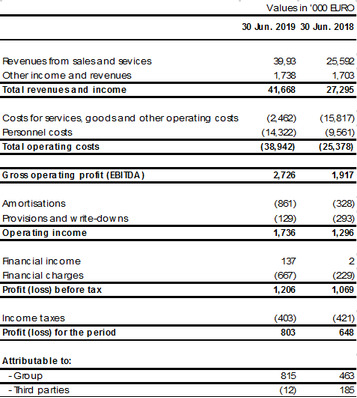

- H1 2019 Consolidated Revenues amounts to €41.7 million, +52.7% compared to €27.3 million in H1 2018.

- H1 2019 EBITDA is €2.7 million, +42.1% compared to €1.9 million in H1 2018.

- H1 2019 EBITDA (ante-IFRS 16 (2) is €2.2 million, +16% compared to €1.9 million in H1 2018.

- H1 2019 EBIT is €1.7 million, +30.8% compared to €1.3 million in H1 2018.ùNet profit in the semester was €0.8 million, +33.3% compared to €0.6 million in H1 2018.

- Net Financial Position (ante-IFRS 16 (3) at 30 June 2019 was €-14.1 million compared to NFP at 31 December 2018, which was €-10.6 million.

Milan, 27 August 2019 – The Board of Directors of Alkemy S.p.A., leading company in the innovation of the business model of large and medium-sized companies and listed on the AIM Italia market of Borsa Italiana since 5 December 2017 (ticker: ALK), has approved today the la Interim Financial Report at 30 June 2019, written in accordance with the IAS/IFRS Principles.

The Group’s consolidated revenues in the first semester of 2019 amounts to €41.7 million, up by 52.7% compared to €27.3 million of H1 2018. This result was also achieved thanks to the integration of new skills and geographical areas acquired through M&A activity.

“The first half of 2019 has been another semester of growth for Alkemy, which this year, as planned, has been and will be engaged in a constant and progressive process of scalability, industrialization and advancement of the organizational structure, following the acquisitions we made last year – Nunatac, Kreativa New Formula and Ontwice Interactive Services – which have provided the group with new professional skills, resources and processes, as well as strengthening our target geographies. In the second quarter of 2019, the integration process of the skills of Design Group Italia (DGI) into Alkemy’s overall offer has also began. In particular, the recent operation with DGI (in whose capital Alkemy entered with an initial 20% stake from July 16th) has represented a strong element of discontinuity in Alkemy’s strategic path. Alkemy is increasingly engaged in shortening the distance between touchpoints / digital channels and physical products / spaces. Growth in the first half of the year concerned both the domestic and international markets, where the Group operates through its subsidiaries Alkemy South Eastern Europe and Alkemy Iberia, whose overall incidence on turnover has exceeded 30%”, stated Alkemy’s Chief Executive Officer Duccio Vitali.

H1 2019 consolidated EBITDA is €2.7 million, up by 42.1% compared to €1.9 million of the first semester of 2018, mainly due to the extension of the Group’s scope and to the application of the IFRS 16 principle (€0,5 million).

Consolidated EBIT of H1 2019 is €1.7 million, compared to €1.3 million in H1 2018 (+30.8%).

The Net Result for the period is equal to €0.8 million, compared to €0.6 million in H1 2018, thus marking a 33.3% growth.

Net financial Position at 30 June 2019 was negative at €-18.4 million (ante-IFRS 16, it was negative at €14.1 million) compared to the negative net financial position at 31 December 2018, which was €10.6 million. This change is mainly related to: the impact of the application of IFRS 16 (€4.3 million), value increase of put liabilities (€0.6 million), and increase in MLT bank debts (€6.1 million), which was partly offset by a higher availability of cash (€3.2 million).

(1) The results at 30 June 2018, recorded in the Interim Financial Report closed on 30 June 2019, are subject to adjustment to International accounting Standards (IAS/IFRS) and therefore differ from those reported in the Interim Financial Report at 30 June 2018, which were written in accordance with National Accounting Standards (Italian GAAP).

(2) IFRS 16-‘Leasing’: the accounting of costs for operating leases is replaced by the amortization of the right-to-use an asset and by financial charges on the liabilities of the leasing contracts.

(3) IFRS 16-‘Leasing’: it involves the recognition of figurative financial debts representing the future commitments related to existing leasing contracts.

With reference to the accounting data shown in this press release, it is specified that for these data the independent auditing activity has not been completed. For more information, please refer to the annexed documents and the Company’s website www.alkemy.com.

ANNEXES

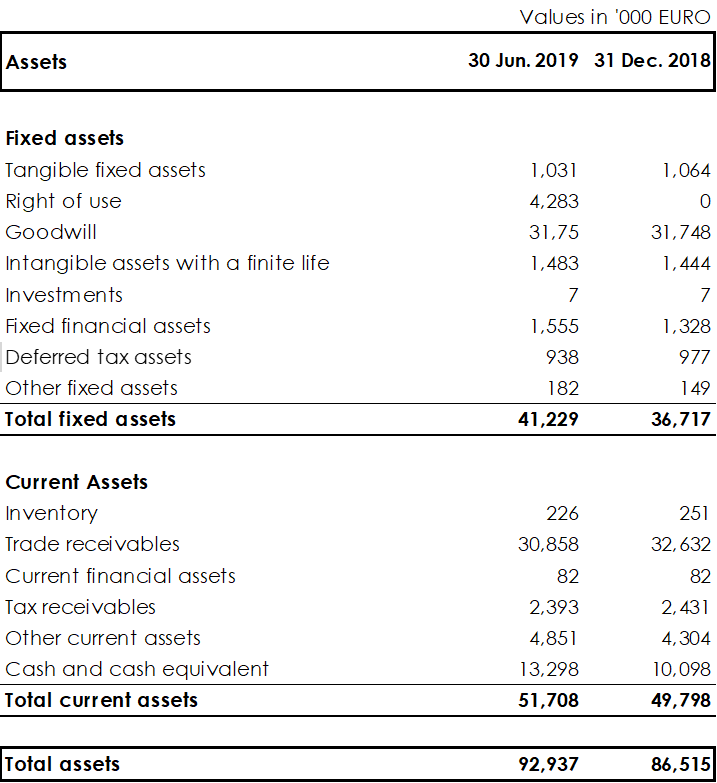

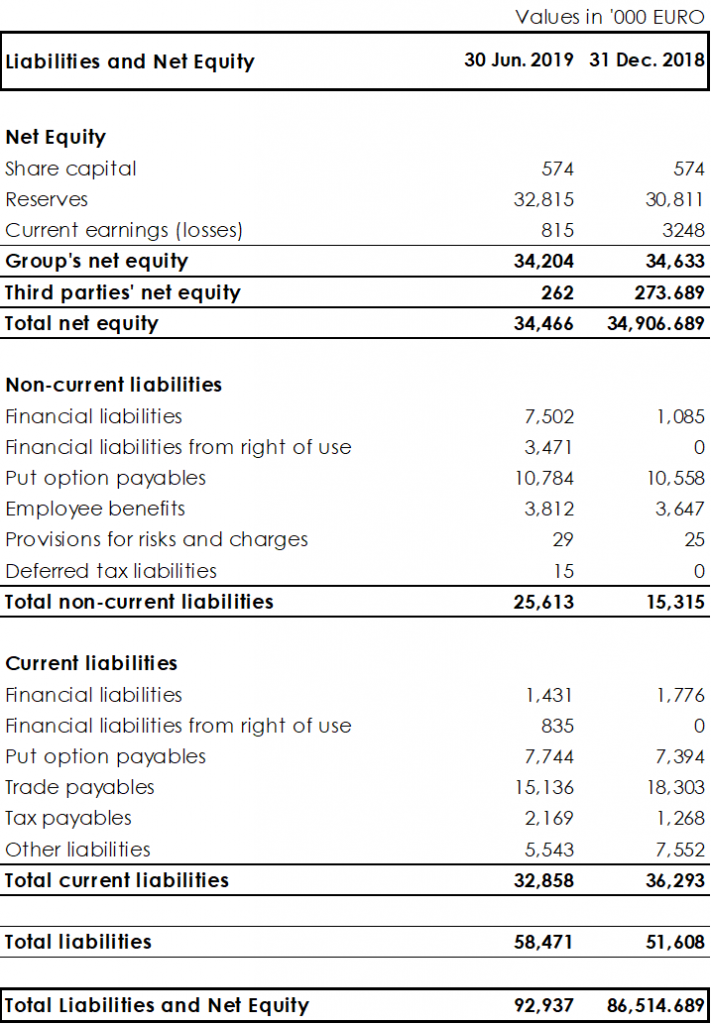

CONSOLIDATED BALANCE SHEET

CONSOLIDATED BALANCE SHEET

CONSOLIDATED PROFIT & LOSS

CONSOLIDATED STATEMENT OF CASH FLOWS

***

Born in 2012 thanks to a group of entrepreneurs who had gained significant experience at leading international companies in the world of business consultancy and technological innovation, Alkemy S.p.A. works to improve the market position and competitiveness of large and medium-sized companies — innovating and transforming their business model according to the evolution of technology and consumer behaviour. The Company integrates skills and expertise in the areas of strategy, e-commerce, communication, performance, technology and data analytics into its offer, and manages wide-ranging digital transformation projects that cover the entire value chain, from strategy to implementation.