Renowned international investors like Jan Hammer, Oleg Boyko and Tom Wilson name fintech industry the biggest blue ocean of business opportunities and this is why

Millennials are the first generation that grew up with the internet boom, a generation that consists of 83 million digital natives, with one-third never using a physical banking office.

It’s a generation that is forgetting about traditional financial services, opting for more inclusive and more convenient digital alternatives that are easily accessible from their mobile phones.

It’s a FinTech generation that has access to services that allow them to open an account in minutes, take out a loan with minimal effort, or send money across the globe at the touch of a button.

Oleg Boyko, Chairman of Finstar Financial Group, calls this Fintech industry “the biggest blue ocean” in the business world, with products and services designed especially for those individuals who don’t otherwise have access to traditional financial services and those who are underserved by mainstream banks. Mr. Boyko assumes that customers are being exposed to, and increasingly expecting, unparalleled speed and convenience from their financial service providers, and are demanding products and services that can be delivered anytime, anywhere, instantly and on their terms. Alternate financial services have been the first to respond these needs.

The Millennial generation do face some challenges.

The average age for homeownership has increased by 8.4% in the last 15 to 20 years, with individuals not qualifying for a mortgage or unable to afford a down payment, as some of the main reasons why.

Growing up in era of digital revolution coupled with coming of age during one of history’s worst economic recessions (the 2008 banking crisis) has had a profound effect on Millennial’s financial behaviour, what they expect from their financial providers, how they interact with them, and what services and products they are looking for.

The 2017 Millennial Money Mindset Report showed that, with the average debt for married Millennials at $121,525, the top priority is to pay down debt, followed closely by increasing income. The biggest challenges to improving financial situations include having to prioritize multiple goals and financial needs at the same time, developing a financial plan, and managing debt.

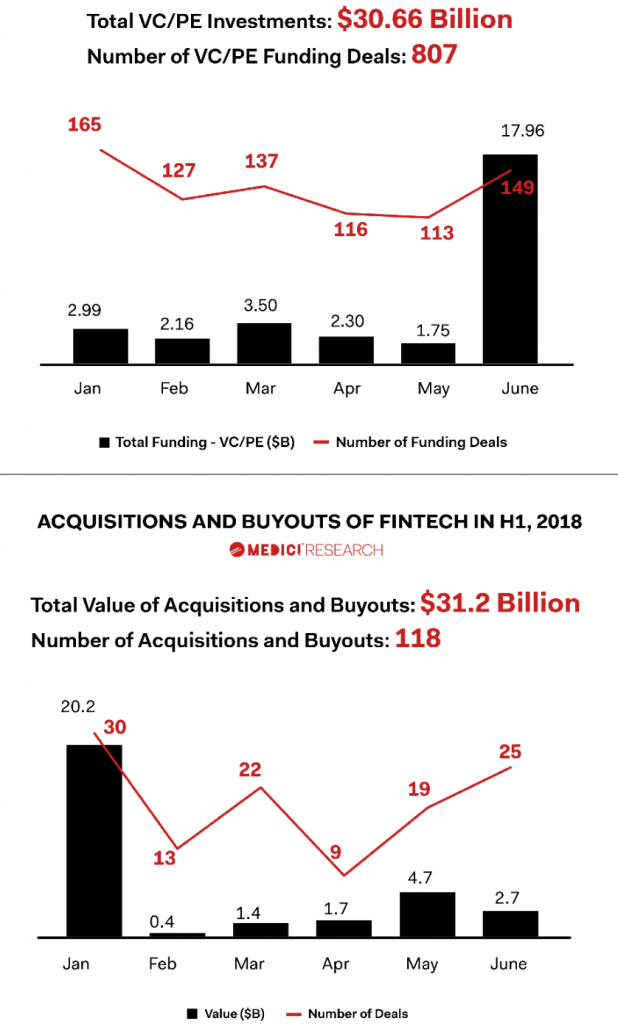

These challenges are a big driving force behind FinTech innovation. We are seeing a constant increase in FinTech activity year-on-year and 2018 is already breaking records, with more than $61 billion FinTech investment in the first 6 months alone, as Millennials are searching for speed, accessibility, comfort, ease-of-use, and most importantly, cost-savings from their financial products and services.

Even though Millennials only hold around 4% of the wealth, compared to 50% of Baby Boomers and 33% for the Silent Generation, the average age of customers on digital investment app Robinhood, is only 28 and 78% is under 35. Two-thirds of customers on the online financial advisor platform, Betterment, are also Millennials with the average age being 35. And micro-investing startup, Acorns, has 4 million subscribers, again consisting primarily of Millennials.

It’s no surprise then that one of the biggest IPO’s in Europe so far this year was Ayden, a revolutionizing FinTech platform that was developed specifically to challenge the payments processing domination of traditional financial services like banks and credit card issuers. They raised over $1 billion with the share price doubling on the first day of trading.

Funding Circle, a peer-to-peer alternative lending platform, is also planning a high-profile IPO that could see the company increase in value to almost $2.5 billion.

The mobile revolution is another big factor that is driving the millennial generation to seek out and demand innovative FinTech solutions. Millennials were the first generation that was exposed to smartphone technology at a relatively young age. As such, according to research by the American Bankers Association, 77% of Digital Natives say their mobile phone never leaves their side and they are three times more likely to open an account through a mobile application than in person.

In the same breadth, 23% (almost a quarter) say that the lack of a mobile app is the main barrier to bank engagement, 53% don’t think their bank offers anything unique and, in fact, 71% of Millennials would rather go to the dentist than listen to what banks are saying.

Stats like these go a long way to explain why app-only banks, such as Starling, have grown their user base fivefold in 2018 and why Monzo and Revolut have reached FinTech unicorn status with valuations of over $1 billion in a relatively short space of time. These digital banking alternatives cater exactly to the needs of the millennial challenges, offering instant updates that make it easier to track and monitor bank balances, more user-friendly interfaces and generally more engaging user experiences.

Post-crisis traditional financial institutions are also hesitant to take on additional risk and have pushed the Millennial generation – who earn on average 4% LESS than the generation before them (Generation X), compared to Generation X who earn 54% MORE than the Baby Boomer generation before them – to alternative lending providers.

Digital, non-bank lending is expected to hit $122 billion by 2020, a tenfold increase in six years. These alternative financing platforms are able to reach a wider and more diverse customer base, including the 2 billion unbanked and underserved individuals around the globe, through advanced mobile technologies and applications. They typically also provide a much more frictionless user experience with rapid customer onboarding, the ability to approve applications in a matter of minutes and able to give customers fast financial relief by reducing fund transfers to hours, instead of days.

According to Oleg Boyko, it’s exactly here, for the 2 billion unbanked and underserved individuals, where FinTech enabled services, combined with innovative mobile applications, can have the biggest impact on a person’s quality of life.

“There are roughly 2.5 billion people in the world underserved by traditional financial products and services. Those people are often concentrated in developing economies and frontier markets. However, even in mature markets, there are first-time financial consumers – Millennials in particular – for whom the old ways of banking don’t stack up. What we have, therefore, is a brilliant opportunity to rethink financial services and to reframe financial services so they serve this community” said Boyko.

Advancements in technology are also lowering the barrier to entry. For example, the cost of establishing an internet-based startup has fallen from $3 million in the 1990’s to just $300 today.

That means more startups can afford to bring their product to market without being pushed out by larger players, fuelling increased innovation by giving customers more choice in the range of products and services available to them.

Millennials are the first generation where technology plays such an extensive role in how they spend, save and invest. The demand for higher quality mobile apps, with a broader range of innovative and personalised services, is not only driving financial innovation but, at the same time, the mobile revolution, away from brick and mortar offices and static desktops.

Add to this the unique combination of challenges that Millennials face, including huge student debts, coming of age in a global economy where traditional financial providers are hesitant to lend, increased housing costs and stagnant salaries, it’s clear that the challenges of the Millennial generation are the true driving force behind the FinTech boom.

(Source: MEDICI)