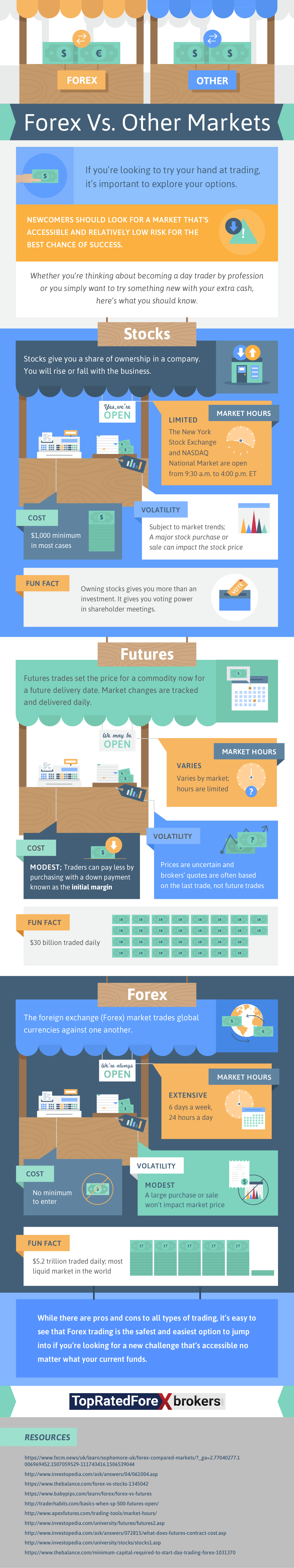

If you’re interested in trying your hand at trading, you have several options available. It’s important to know the differences between each option so you can choose the one that suits your needs the best. When you purchase a stock, you own a share of that company, and your stock will rise and fall depending on how well or poorly that company is doing. The market hours are only open when the New York Stock Exchange and NASDAQ National Market are open. In most cases, you’ll need a minimum of $1,000 to purchase stock.

When you purchase futures, you buy a commodity today for a future delivery date. While the market hours will vary depending on which market you’re buying in, the hours are limited. Additionally, while the cost to buy futures is modest, and you can pay less if you purchase with a down payment called the initial margin, it’s a volatile market and prices are uncertain.

Another option is the foreign exchange market, also known as Forex. In the Forex market, you trade global currencies against each other. This market is open 24 hours a day and six days a week. There’s no minimum amount needed to enter the market, and it has modest volatility since a large sale or purchase won’t impact the price. With over $5 trillion traded every day, it’s the most liquid market in the world. Whether you’re interested in becoming a day trader or simply want to dabble in the markets, keep reading to learn more about trading from the infographic Forex vs Other Markets.