In the near future, online banking and payments will go through some fascinating changes beyond what has already happened over the past several years. Although some people feel more comfortable going to a brick-and-mortar bank, others recognize the incredible value associated with doing business online.

Because both customers and retailers have ever-changing needs, the evolution of fintech solutions will continue. Diverse online banking and payment solutions that are currently available will become even better and more powerful. Both customers and retailers are excited about the upcoming strategies and the way they will forever change the banking industry as a whole.

Advanced Mobile Payments

Mobile technologies have impacted the financial sector specific to online banking and payments. MasterCard’s recently launched program is a perfect example. Typically, a user enters a numeric and letter password to gain access to accounts, but with this program, a selfie is used.

Today, there is increasing demand for biometric authentication apps. To ensure that consumers get what they want, MasterCard is going a step further by developing facial identification, voice recognition, and even cardiac rhythm programs. These innovative solutions will enhance the mobile payment experience for customers and retailers alike.

Current apps for streamlined online payments, along with those being developed for future use, offer a higher level of security. A benefit of retailer-specific payment apps is that a customer can buy from one particular merchant while being fully protected. This is possible because information is never stored on the merchant’s device, only on the device of the user.

Growing Opportunities for Mobile Wallets

Mobile wallets are among the most drastic changes seen by online banking and payments, and they are beneficial to both customers and retailers. With each purchase that customers make with mobile wallets, retailers gain insight into shopping behavior. This gives retailers a clearer understanding of the type of products and services that people purchase most. This allows them to make necessary changes to what they offer, which in turn enhances the shopping experience.

Customers also enjoy many benefits offered by mobile wallets. With this solution, physical retail stores will attract a greater number of customers. That helps increase sales and revenue generated.

Back in 2014, Apple was the only real contender for mobile wallets. Within just one year, others followed their lead, including Samsung and Google. Then, in just a short amount of time, more big-name players joined in, such as Chase, Amazon, and Walmart. However, that was not the end. Even social media platforms started offering online payment options. With sites like Facebook that have mobile wallet solutions, people can send money and make payments.

With the huge impact on online banking and payments, experts began paying more attention to mobile wallets. Based on current information and emerging trends, they predict the volume of in-store mobile payments will hit $500 billion within the next three years. The growth potential for completing purchases online using mobile devices has skyrocketed.

Another prediction is that by 2025, 75 percent of all transactions will be made using mobile wallets rather than actual cash. In place of cash, people feel more confident using mobile wallets and smart devices.

Greater Demand for Digital Remittances

Sending money around the globe is easier because of digital remittances. With growing popularity and proven success, this option has captured the attention of several startup companies. For instance, a San Francisco-based company founded in 2001 called Xoom has experienced amazing growth because of digital remittances. In fact, it passed up MoneyGram, which speaks volumes.

Growth Potential with Peer-to-Peer Lending

Over the last few years, peer-to-peer lending has experienced significant growth. Instead of using a conventional lender, an increasing number of people rely on this alternative. Along with being easier, the interest charged for peer-to-peer lending is lower. This unique service is offered by a number of innovators. For instance, having originated loans over $20 million since being founded, Lending Club ranks as one of the fiercest competitors in this arena.

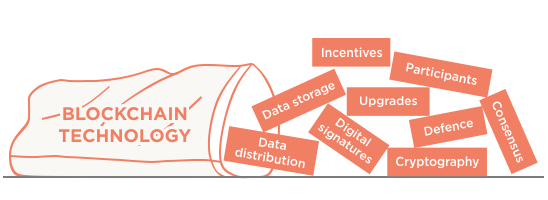

Disruption with Blockchain Technology

With both blockchain technology and cryptocurrency becoming more of a threat to the traditional financial industry, online banking and payments could face serious disruption. In particular, tokenization is expected to have a serious impact.

In response to bitcoin’s introduction, more startup companies got involved. As an example, Movile is working hard to incorporate bitcoin, giving people another mobile payment and in-game purchase option. In Brazil, as well as several other developing countries, bitcoin is already used.

Blockchain will likely be a key disruptor to the financial sector. However, being transparent and trustworthy, this technology has a tremendous amount of support. The reality is that when it comes to making an online payment, the blockchain technology is designed to streamline the process.

Big Opportunities for the Retail Industry

To reach customers and provide customized offers, three things provide amazing opportunities for the retail industry. These include sensors, beacons, and big data. Big data offers an exceptional opportunity for targeting customers with flash sales, coupons, and promotions. Making purchases in advance is another great opportunity.

P2P Making Waves

For a long time, PayPal has been the dominating force in the payment industry. However, P2P is also a viable method for making mobile payments. Using a mobile device, a consumer can make bank transfers with P2P. With competition on the rise, several startups are edging their way in, hoping to take the lead away from PayPal.

This is exactly what Ozan.com would like to achieve. This company is an excellent alternative to traditional banks. One thing that makes it stand out is that no fees are charged for transactions. Venmo, which also offers P2P mobile payments, has its sights set on the same prize.

The type, caliber, and diversity of options for online banking and payments available today are staggering. With the number of growing threats, security is always a priority. Fortunately, the innovative solutions available and those being developed for the banking industry focus on security as well as speeding up transactions.